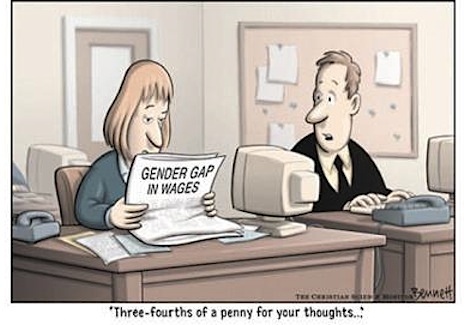

The folks at learnstuff.com have sent me an infographic on the gender wage gap in the United States (click here). The puzzle is this: although women achieve higher scores in college than their male peers, women earn less than men. This holds true across all levels of education. Why? Discrimination may be part of the story, but child-rearing may explain a large chunk of the gap. A neat study would be to look at the effect of child-rearing on the wage gap. In other words, does the wage gap exist for childless women? If so, the puzzle deepens.

Michael Aldous and I had our book The CEO: The Rise and Fall of Britain's Captains of Industry published a few weeks ago. You can find out more about it and buy it at Cambridge University Press's website . It is also available at Amazon , Waterstones , and Barnes & Noble . The CEO has already been reviewed in The Sunday Times , The Observer and Financial Times .