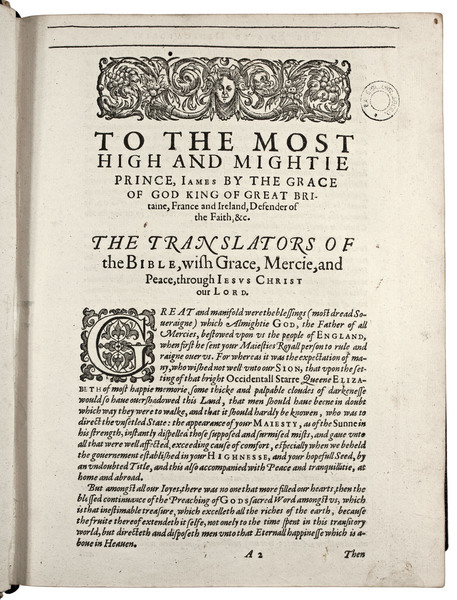

Today the Queen attended a service at Westminster Abbey to mark the 400th anniversary of the Authorised Version (or King James Version) of the Bible. Although scholars have highlighted the impact of this version of the Bible on society (click here), the development of literature and the English language (click here), what has been its impact on economic development?

We can maybe get an answer to this question, if we look at the work of Sascha Becker and Ludger Woessmann, who have recently published a paper in the Quarterly Journal of Economics, which suggests that Bible reading had a powerful impact on economic development in Germany. Below is the abstract of their paper:

Max Weber attributed the higher economic prosperity of Protestant regions to a Protestant work ethic. We provide an alternative theory: Protestant economies prospered because instruction in reading the Bible generated the human capital crucial to economic prosperity. We test the theory using county-level data from late-nineteenth-century Prussia, exploiting the initial concentric dispersion of the Reformation to use distance to Wittenberg as an instrument for Protestantism. We find that Protestantism indeed led to higher economic prosperity, but also to better education. Our results are consistent with Protestants' higher literacy accounting for most of the gap in economic prosperity.