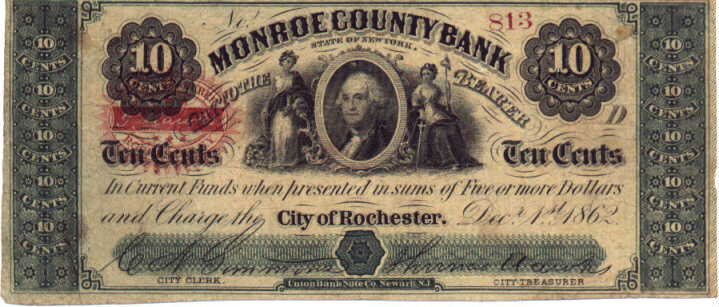

Do banks cause economic growth or are they a result of economic growth? The multitude of banking experiments in U.S. banking history make it a suitable laboratory to test conjectures about the relationship between growth and banking development. Matthew Jaremski and Peter Rousseau in "Banks, Free Banks, and U.S. Economic Growth" look at this relationship in the era prior to the Civil War, and they find that the free banking system had little effect on economic growth. Click here to read Chris Colvin's NEP-HIS review of this paper.

Michael Aldous and I had our book The CEO: The Rise and Fall of Britain's Captains of Industry published a few weeks ago. You can find out more about it and buy it at Cambridge University Press's website . It is also available at Amazon , Waterstones , and Barnes & Noble . The CEO has already been reviewed in The Sunday Times , The Observer and Financial Times .